Control your small business through budgeting is crucial to manage any small business. Every small business needs to check their incomes and expenses to make sure they have enough funds to do everything they want to do AND that needs to be completed.

This is how I started an effective budget for my business.

First, decide what software to use, like QuickBooks or Quicken or an online app that is reliable. Then, setup the file. Follow the instructions. They usually have step by step questions they ask when setting up a new account.

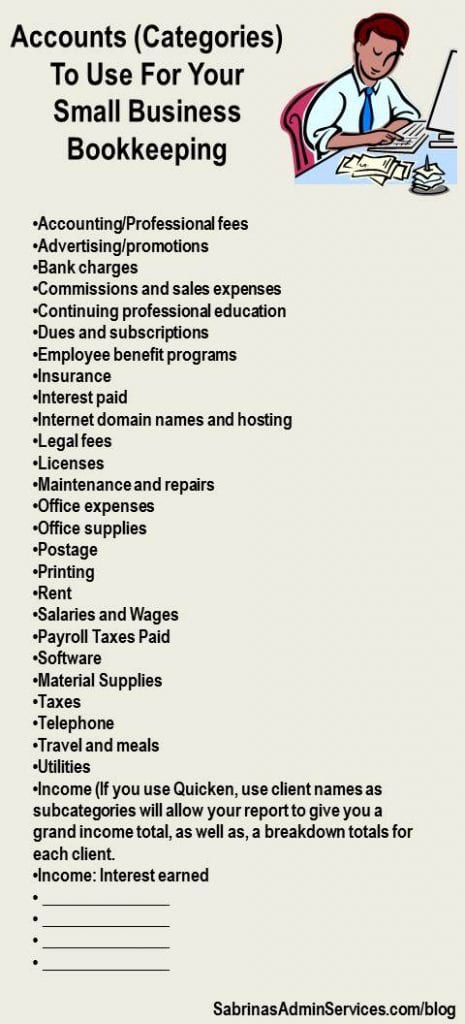

Then, decide what areas to track and make up categories also known as accounts. QuickBooks and Quicken setup a list of accounts already so review them. Not all of them apply to your business. Delete the ones that don’t apply right away. The fewer accounts you have the easier it will be to manage them. Here is a list of account examples that are most frequently used in your chart of account lists:

- Accounting/Professional fees

- Advertising/promotions

- Bank charges

- Commissions and sales expenses

- Continuing professional education

- Dues and subscriptions

- Employee benefit programs

- Insurance

- Interest paid

- Internet domain names and hosting

- Legal fees

- Licenses

- Maintenance and repairs

- Office expenses

- Office supplies

- Postage

- Printing

- Rent

- Salaries and Wages

- Payroll Taxes Paid

- Software

- Material Supplies

- Taxes

- Telephone

- Travel and meals

- Utilities

- Income (If you use Quicken, use client names as subcategories will allow your report to give you a grand income total, as well as, a breakdown totals for each client.

- Income: Interest

If you have other employees that are involved in the spending, getting their opinion in the budgeting process is also valuable. They may handle areas that you are unaware of and will need to be added to the budget.

And to make the budget more effectively, make sure the accounts are used consistently. There are features in QuickBooks and Quicken that track the payee names and associate it with particular accounts. Check out this page from QuickBooks on Memorized Transactions.

Then, check the budget every month for income and every quarter for specific expenses and yearly for the ‘big picture’ overview. When I reconcile the Checking, Savings, and Credit Card accounts, I usually check my budget accounts to see what categories were used or needs to be added or hasn’t used.

Staying in control of your small business will help you see where you are spending too much and where you need to refocus your time.

Original article and pictures take sabrinasadminservices.com site

Комментариев нет:

Отправить комментарий